Plainfield Township has Until September 8, 2025, to Protest Taxes

O'Connor discusses that Plainfield Township property owners has until September 8, 2025, to protest their taxes.

CHICAGO, IL, UNITED STATES, September 4, 2025 /EINPresswire.com/ -- The Chicago metropolitan area is one of the largest in the United States and continues to grow at a breakneck pace. The collar counties which surround Cook County and Chicago are seeing a huge influx of people as the areas become more suburban each year. The collar counties are seen as having better schools, lower crime, and more space to live in. However, as more people arrive to pursue the dream of homeownership, property values across the collar counties have begun to rise every year, along with the record taxes that one can expect in Illinois.Plainfield Township is one of the fastest-growing townships in Illinois. While it is a relatively long commute from Chicago, many residents find it to be worth the effort. Joliet, also in Will County, is much closer and also a great place to work. With the transformation from rural villages to bustling suburbs taking only two decades, things have certainly been shaken up in the region. This fresh population boom, like many other collar county townships, has made residential and commercial property demand shoot to the stratosphere. With it comes higher property values and taxes. When exemptions are not enough, residents are turning to property tax appeals, which are quickly becoming a necessity in Illinois. The deadline for all appeals is set for September 8, 2025.

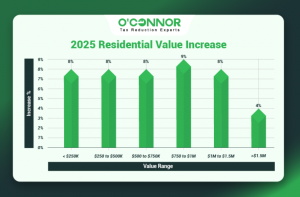

Plainfield Township’s property value is almost exclusively in homes. In 2025, the total value of homes was estimated to be $9.28 billion, compared to the commercial property value of only $36.29 million. This is the starkest disparity between the two that we have seen so far in our blog series. As Plainfield Township is an ascended rural area, this is not completely surprising, but it certainly brings home the reliance on Chicago, Aurora, and Joliet. The growing demand for homes drove up the overall value total by 8%, adding more than $720 million in taxable value in a single year.

The largest block of homes was those assessed from $250,000 to $500,000. These modest homes generated $7.33 billion in total value and experienced an increase of 8%. These were followed by homes worth $500,000 to $750,000, which also grew by 8% for a combined total of $1.22 billion. In a distant third place, residences worth under $250,000 managed to account for $668.70 million. Even the most modest of homes added an 8% increase to their value.

While residential property aimed at the middle-class was by far the most important, luxury properties have been gaining a foothold in Plainfield as well. $52.80 million in value came from homes worth between $750,000 and $1 million. These larger homes increased by 9%, the highest percentage gain of all categories. While only contributing $12.52 million to the total, homes assessed from $1 million to $1.5 million logged 8% in growth. To cap things off, a few giant residences combined for $8.70 million, with an uptick of 4%. It is clear that luxury homes saw little new construction, but rather simply increased in taxable value.

Plainfield vs. Other Townships

Each township in the collar counties has its own history and story to tell, and we can learn much by comparing them. We will leave Chicago out of this, as it has its own unique twists. Increases in home values are universal across the board, however. In Will County, Joliet Township experienced a jump of 10% in home values. In Kane County, Aurora Township also saw 10% growth, while most other townships, including Batavia, Geneva, and Rutland all spiked by 9%. Dorr and Richmond townships in McHenry County each surged by 11%. Lake County saw the largest variation, with Fremont Township growing by 10%, while Waukegan added 8% and Wauconda added 7%.

Small and Mid-Sized Businesses Grow Slightly

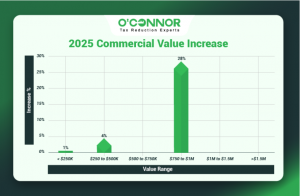

As mentioned above, commercial properties are valued at only a fraction of those for residential real estate. This is mostly thanks to Plainfield Township’s status as a suburb to many other urbanized areas. While Plainfield’s business properties only totaled $26.28 million, Joliet Township, for instance, had a total of $1.47 billion. Despite their small total, the commercial properties in Plainfield did manage to see an increase of 3%. This was not, however, typical Illinois fashion.

The pattern of value and growth in business properties across Illinois is generally top-heavy. The largest commercial properties are responsible for the most value and growth. This is partially true in Plainfield Township, as businesses worth over $1.5 million contributed $19.11 million of all value, which is over half. The big difference is that these properties saw no growth whatsoever. This is a rarity in Illinois, or indeed any area in the United States. Commercial properties assessed at $1 million to $1.5 million likewise experience no growth.

This pattern was finally broken when it came to commercial properties assessed at $750,000 to $1 million. These mid-sized businesses added an astounding 28%, growing their total to $3.60 million. It was thanks to these businesses that Plainfield Township saw an overall increase. This seems to be an outlier, as the next tier of commercial real estate saw zero growth as well. Those worth between $250,000 and $500,000 saw an uptick of 4%, while those under $250,000 saw a tiny rise of 1%. This could certainly be seen as a good sign for business owners, as assessors across the collar counties have been targeting large properties lately, meaning Plainfield Township has perhaps been spared the worst of it.

September 8, 2025, is the Last Day to Appeal

While businesses are seeing a strange mixed bag, homeowners are feeling yet another attack on their wallets. With such an outsized impact on the region, these homes make up the majority of the tax base for the township and could be targeted by rising tax rates on top of these new values. The Plainfield Township Assessor may set property values, but tax rates are set by dozens of individual bodies, each looking for a slice so they can satisfy their budgetary needs. School districts are the largest of these and are usually the main target addressed by exemptions.

With new construction and home sales reaching a fever pitch, it is common for homeowners to see their values rise without doing anything. The only remedy is to deploy property tax appeals to even the odds. These will force the assessor to take an honest valuation for the property, rather than simply using guesstimates or mass-appraisal means. If these informal appeals to the assessor are not enough, then a formal protest to the Board of Review (BOR) is necessary. This board is a group of three experts that will rule on the evidence that the taxpayer and the assessor present. The BOR has a history of siding with homeowners, making it an attractive choice.

No matter what step you wish to take, you must file your appeal by September 8, 2025. The people of Chicago may have several deadlines spread out over months, but taxpayers in the rest of Illinois do not have that luxury. This means that you have only one shot to file an informal or formal appeal to protect your home or business. If you do not contest the values now, you will be forced to pay tax bills next year that are significantly higher, a cycle that will only continue unless it is addressed.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.